All Categories

Featured

Table of Contents

If you're healthy and have never made use of cigarette, you'll normally pay even more for home loan defense insurance coverage than you would for term life insurance policy (mortgage protection and home insurance). Unlike other kinds of insurance coverage, it's challenging to obtain a quote for mortgage defense insurance online - is mortgage life insurance mandatory in canada. Costs for mortgage defense insurance policy can vary widely; there is much less transparency in this market and there are also several variables to precisely compare rates

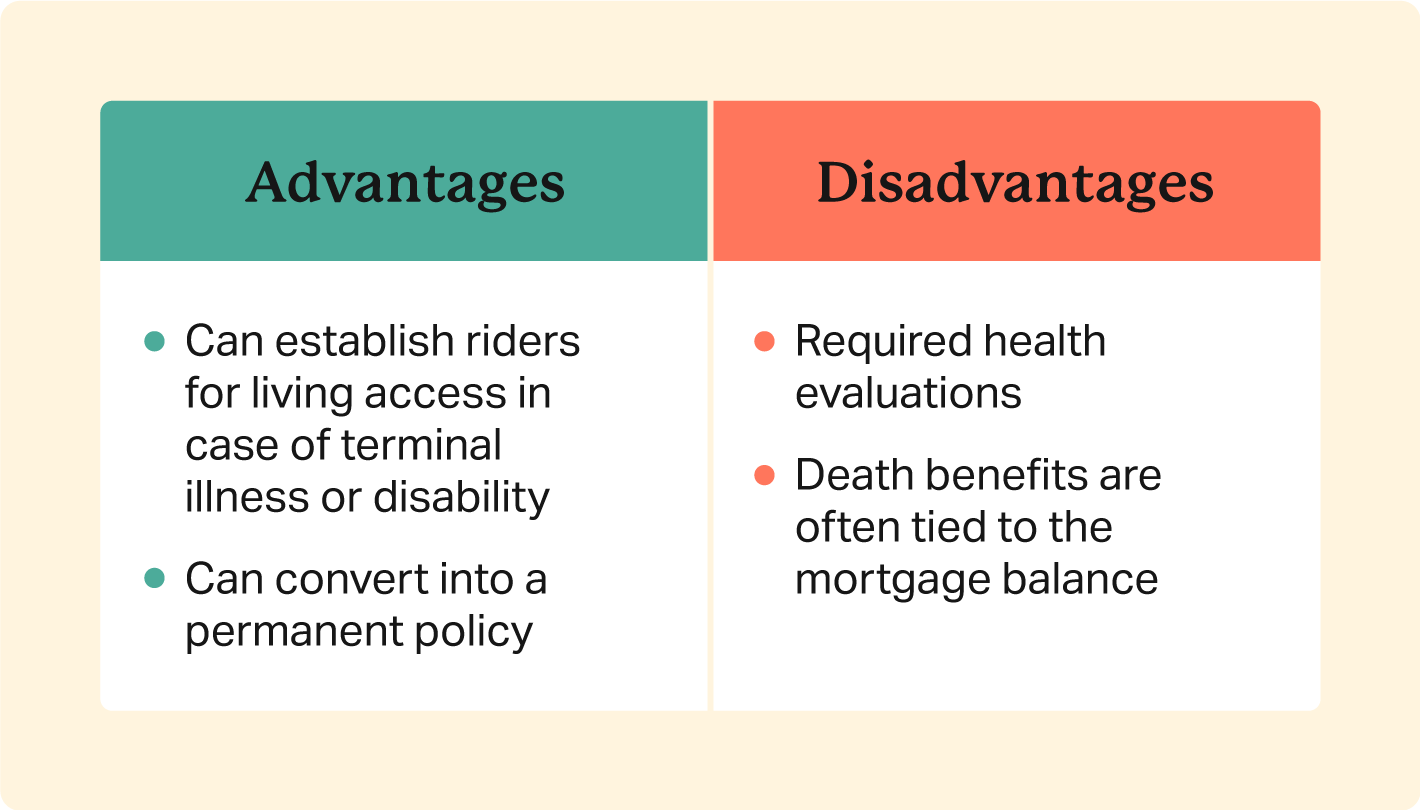

Term life is an outstanding choice for home mortgage protection. Policyholders can profit from numerous benefits: The quantity of protection isn't restricted to your mortgage equilibrium.

You might want your life insurance policy policy to safeguard more than just your home loan. You select the plan worth, so your insurance coverage can be extra or less than your home mortgage balance. You could also have greater than one policy and "pile" them for customized protection. By stacking plans, or bikers on your plan, you might lower the life insurance policy benefit with time as your home mortgage balance decreases so you're not spending for insurance coverage you don't require.

If you're insured and pass away while your term life policy is still active, your picked liked one(s) can make use of the funds to pay the home mortgage or for one more function they select. reclaim mortgage ppi. There are several advantages to using term life insurance to protect your mortgage. Still, it might not be an excellent service for everybody

Mortgage Protection For Job Loss

Yes and no. Yes, due to the fact that life insurance policy plans have a tendency to align with the specifics of a home loan. If you acquire a 250,000 home with a 25-year home mortgage, it makes good sense to buy life insurance policy that covers you for this much, for this lengthy. In this way if you die tomorrow, or any time throughout the next 25 years, your home mortgage can be cleared.

Your household or recipients obtain their swelling sum and they can spend it as they such as (unemployment insurance mortgage). It is very important to recognize, nevertheless, that the Home mortgage Defense payout amount decreases in accordance with your home mortgage term and balance, whereas degree term life insurance policy will pay out the same round figure at any type of time throughout the plan size

Legal And General Mortgage Protection Insurance

On the other hand, you'll be to life so It's not like paying for Netflix. The amount you spend on life insurance coverage every month does not pay back till you're no much longer below.

After you're gone, your loved ones don't need to fret about missing repayments or being unable to manage living in their home (home loan protection insurance tax deductible). There are 2 primary ranges of home loan protection insurance coverage, level term and decreasing term. It's constantly best to get recommendations to figure out the policy that best talks to your needs, budget plan and situations

Latest Posts

Burial Insurance Senior Citizens

Best Final Expenses Insurance

Final Expense Life Insurance Definition