All Categories

Featured

Table of Contents

Insurance provider will not pay a small. Rather, take into consideration leaving the money to an estate or trust fund. For even more extensive information on life insurance policy get a copy of the NAIC Life Insurance Policy Customers Overview.

The internal revenue service places a limitation on exactly how much cash can enter into life insurance policy premiums for the policy and exactly how quickly such premiums can be paid in order for the plan to keep all of its tax obligation advantages. If certain restrictions are exceeded, a MEC results. MEC policyholders might be subject to tax obligations on distributions on an income-first basis, that is, to the degree there is gain in their plans, along with penalties on any type of taxable quantity if they are not age 59 1/2 or older.

Please note that exceptional financings build up rate of interest. Revenue tax-free treatment also assumes the car loan will become satisfied from revenue tax-free survivor benefit profits. Lendings and withdrawals decrease the plan's cash money worth and death benefit, might create certain plan advantages or cyclists to become not available and might increase the opportunity the plan may lapse.

A client may qualify for the life insurance policy, however not the biker. A variable universal life insurance policy agreement is a contract with the primary purpose of supplying a fatality benefit.

Trust Planning

These profiles are very closely managed in order to satisfy stated financial investment purposes. There are fees and fees connected with variable life insurance coverage contracts, including death and threat fees, a front-end load, management fees, investment administration costs, surrender fees and fees for optional bikers. Equitable Financial and its associates do not give lawful or tax obligation recommendations.

Whether you're beginning a family members or obtaining married, individuals generally begin to consider life insurance policy when somebody else starts to rely on their capability to earn a revenue. Which's fantastic, because that's precisely what the death advantage is for. But, as you find out more concerning life insurance policy, you're most likely to discover that several policies as an example, whole life insurance policy have much more than just a survivor benefit.

What are the benefits of entire life insurance policy? One of the most enticing advantages of buying a whole life insurance plan is this: As long as you pay your premiums, your fatality advantage will never end.

Believe you do not require life insurance if you do not have kids? There are lots of advantages to having life insurance coverage, also if you're not sustaining a family.

What is the process for getting Trust Planning?

Funeral expenses, burial costs and clinical expenses can add up. Long-term life insurance coverage is offered in different quantities, so you can choose a fatality advantage that satisfies your requirements.

Identify whether term or irreversible life insurance coverage is right for you. After that, get a quote of just how much protection you may need, and just how much it could cost. Locate the correct amount for your budget plan and assurance. Locate your quantity. As your individual circumstances modification (i.e., marriage, birth of a youngster or task promo), so will your life insurance policy needs.

Essentially, there are 2 sorts of life insurance policy plans - either term or irreversible strategies or some combination of the two. Life insurers offer numerous forms of term plans and standard life policies in addition to "rate of interest sensitive" items which have come to be a lot more prevalent since the 1980's.

Term insurance coverage provides protection for a given amount of time. This duration might be as short as one year or supply insurance coverage for a details variety of years such as 5, 10, twenty years or to a specified age such as 80 or in some situations approximately the earliest age in the life insurance policy mortality.

Why should I have Legacy Planning?

Presently term insurance coverage prices are extremely competitive and among the lowest traditionally seasoned. It needs to be noted that it is a commonly held belief that term insurance coverage is the least pricey pure life insurance policy coverage offered. One needs to evaluate the plan terms carefully to choose which term life choices appropriate to meet your specific situations.

With each brand-new term the premium is enhanced. The right to restore the plan without proof of insurability is an important benefit to you. Or else, the danger you take is that your health might wear away and you might be unable to acquire a plan at the very same rates or perhaps whatsoever, leaving you and your beneficiaries without coverage.

The length of the conversion period will vary depending on the type of term plan bought. The premium rate you pay on conversion is normally based on your "existing acquired age", which is your age on the conversion day.

Under a level term plan the face quantity of the policy remains the exact same for the whole period. Often such policies are marketed as home loan defense with the amount of insurance coverage decreasing as the balance of the home loan reduces.

Where can I find Cash Value Plans?

Typically, insurance firms have not had the right to change premiums after the policy is offered. Given that such policies may continue for many years, insurance providers need to utilize conventional mortality, interest and expense rate quotes in the premium calculation. Adjustable costs insurance policy, however, enables insurance firms to provide insurance coverage at lower "current" costs based upon much less conservative presumptions with the right to alter these premiums in the future.

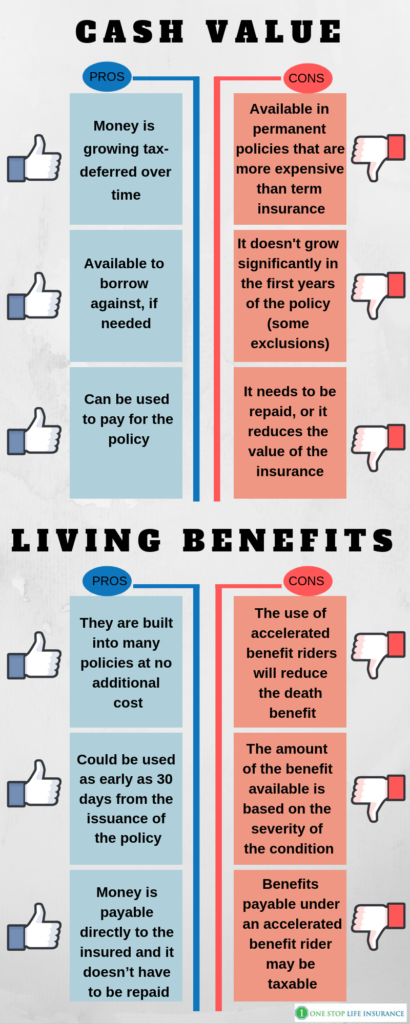

While term insurance policy is created to provide security for a specified amount of time, permanent insurance policy is designed to offer protection for your entire life time. To keep the premium rate level, the premium at the younger ages exceeds the real expense of security. This extra premium builds a reserve (cash money value) which helps pay for the policy in later years as the price of security surges over the premium.

The insurance coverage business spends the excess costs dollars This kind of policy, which is occasionally called cash worth life insurance coverage, produces a savings component. Cash values are vital to a permanent life insurance coverage policy.

Table of Contents

Latest Posts

What is Term Life Insurance For Couples and Why Choose It?

How do I apply for Level Term Life Insurance Quotes?

What is Life Insurance? Key Information for Policyholders

More

Latest Posts

What is Term Life Insurance For Couples and Why Choose It?

How do I apply for Level Term Life Insurance Quotes?

What is Life Insurance? Key Information for Policyholders